Please Choose Your Language

Views: 222 Author: Carie Publish Time: 2025-02-23 Origin: Site

Content Menu

● 1. Sustainability and Green Chemistry

>> Innovations in Green Chemistry

● 2. Digitalization and AI-Driven Innovation

>> Case Study: AI in Chemical Manufacturing

● 3. Supply Chain Resilience and Localization

>> Impact of Supply Chain Localization

● 4. Growth in Specialty and High-Performance Chemicals

>> Emerging Applications of Specialty Chemicals

● 5. Hydrogen and Carbon Capture Technologies

● 6. Regulatory Landscape and Compliance

● 7. Innovations in Chemical Recycling

>> Case Study: Chemical Recycling Initiatives

● FAQ

>> 1. What are the main drivers of sustainability in the chemical industry?

>> 2. How is digitalization impacting chemical manufacturing?

>> 3. Why is supply chain resilience important for chemical companies?

>> 4. What role do specialty chemicals play in modern industries?

>> 5. How can hydrogen technologies contribute to sustainability?

As we approach 2025, the chemical industry is undergoing significant transformations driven by sustainability, technological advancements, and shifting market demands. The focus on chemical raw materials is more critical than ever as industries seek to balance performance with environmental responsibility. This article explores the key trends shaping the chemical raw materials sector, highlighting innovations and practices that will define the industry in the coming years.

The demand for sustainable chemical raw materials is escalating. Companies are increasingly adopting green chemistry principles, which emphasize the design of chemical products and processes that reduce or eliminate hazardous substances. This shift is driven by:

- Regulatory Pressures: Governments worldwide are implementing stricter regulations to curb pollution and promote environmentally friendly practices. For example, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation aims to protect human health and the environment from risks posed by chemicals.

- Consumer Demand: There is a growing preference among consumers for products made from sustainable materials, pushing companies to innovate. Brands that prioritize sustainability often enjoy increased customer loyalty and market share.

- Circular Economy Practices: The adoption of circular economy models encourages the recycling and reuse of materials, reducing waste and resource consumption. This approach not only minimizes environmental impact but also creates new business opportunities in recycling technologies.

Innovations in green chemistry are leading to the development of bio-based chemicals derived from renewable resources such as plants and waste materials. For instance, bioplastics made from corn starch or sugarcane are gaining traction as alternatives to traditional petroleum-based plastics. Additionally, advancements in enzymatic processes are allowing for more efficient production methods that minimize energy use and waste generation.

The integration of digital technologies in chemical manufacturing is transforming operations. Key aspects include:

- Data Analytics: Companies are leveraging data analytics to optimize production processes, enhance safety, and reduce costs. Predictive maintenance powered by data analytics can significantly decrease downtime and maintenance costs.

- AI in R&D: Artificial intelligence is streamlining research and development, enabling faster innovation cycles for new chemical raw materials. AI algorithms can analyze vast datasets to identify potential new compounds or optimize existing processes.

- Digital Twins: The use of digital twins allows for real-time monitoring and simulation of chemical processes, improving efficiency. By creating a virtual model of a chemical plant, operators can test changes without disrupting actual production.

A leading chemical manufacturer implemented AI-driven predictive analytics to forecast equipment failures before they occurred. This proactive approach reduced unplanned downtime by 30%, resulting in significant cost savings.

Recent global events have highlighted vulnerabilities in supply chains. As a result, companies are focusing on:

- Regional Sourcing: To mitigate risks associated with geopolitical tensions, businesses are investing in local suppliers for chemical raw materials. This trend not only enhances supply chain stability but also supports local economies.

- Reshoring Operations: Many companies are bringing manufacturing back to their home countries to ensure greater control over their supply chains. Reshoring can also reduce transportation emissions associated with long-distance shipping.

- Alternative Raw Materials: There is a push towards finding alternative sources for raw materials to reduce dependence on specific regions. For instance, companies are exploring agricultural waste as a feedstock for bio-based chemicals.

The localization of supply chains has led to increased collaboration between manufacturers and local suppliers, fostering innovation and reducing lead times. Additionally, localized supply chains can enhance transparency and traceability in sourcing practices.

The demand for specialty chemicals is on the rise, particularly in sectors such as:

- Electronics: Specialty chemicals are crucial for manufacturing semiconductors and other electronic components. The miniaturization of electronics has led to an increased need for high-purity chemicals that meet stringent quality standards.

- Pharmaceuticals: The pharmaceutical industry relies heavily on high-performance chemicals for drug formulation. As personalized medicine gains traction, there is an increasing demand for custom synthesis of active pharmaceutical ingredients (APIs).

- Renewable Energy: As the world shifts towards renewable energy sources, there is an increasing need for specialty chemicals used in batteries and solar panels. For example, lithium-ion batteries require high-purity lithium salts that are critical for performance.

Specialty chemicals are also finding applications in emerging fields such as nanotechnology and biotechnology. These advanced materials enable innovations across various industries, including healthcare, energy storage, and environmental remediation.

The chemical sector plays a pivotal role in addressing climate change through:

- Hydrogen Production: Investments are being made in both blue and green hydrogen technologies as alternatives to fossil fuels. Blue hydrogen involves producing hydrogen from natural gas while capturing carbon emissions, whereas green hydrogen is produced through electrolysis using renewable energy sources.

- Carbon Capture Utilization (CCU): Technologies that capture carbon emissions from industrial processes are becoming integral to achieving sustainability goals. CCU not only reduces greenhouse gas emissions but also enables the conversion of captured CO2 into valuable products such as fuels or chemicals.

The hydrogen economy is gaining momentum as governments invest in infrastructure for hydrogen production, storage, and distribution. This transition could lead to a significant reduction in carbon emissions across multiple sectors.

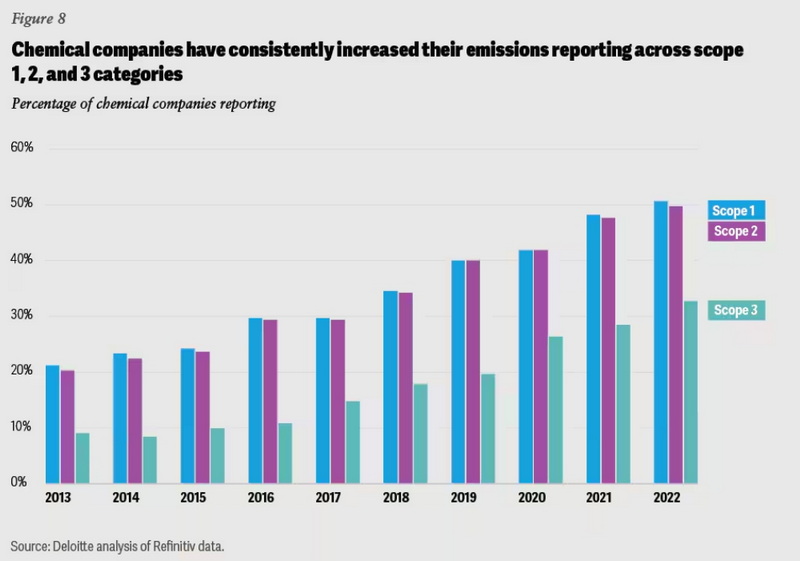

As sustainability becomes a priority globally, regulatory frameworks surrounding chemical raw materials are evolving rapidly:

- Stricter Regulations: Countries are implementing stricter regulations regarding the use of hazardous substances in chemical manufacturing processes.

- Compliance Challenges: Companies must navigate complex compliance landscapes while striving to meet sustainability targets.

- Sustainability Reporting: Transparency regarding sourcing practices has become essential; companies may be required to disclose their sustainability efforts publicly.

To effectively navigate these challenges, companies can invest in compliance management systems that streamline reporting processes while ensuring adherence to regulations.

As part of the broader sustainability movement, innovations in chemical recycling are gaining traction:

- Chemical Recycling Technologies: Unlike traditional mechanical recycling methods that often degrade material quality, chemical recycling breaks down plastics into their original monomers or other useful chemicals. This process allows for infinite recyclability without loss of quality.

- Collaboration Across Industries: Partnerships between chemical manufacturers and waste management firms are essential for developing effective recycling technologies that can handle diverse plastic waste streams.

Several companies have launched pilot projects focusing on advanced recycling technologies capable of processing complex plastic waste that traditional methods cannot handle. These initiatives aim to create a closed-loop system where waste becomes a resource.

As we look ahead to 2025, the trends shaping the chemical raw materials industry reflect a broader commitment to sustainability, innovation, and resilience. Companies that embrace these changes will not only enhance their competitive edge but also contribute positively to global environmental goals. The shift towards greener practices, digital transformation, localized supply chains, advanced specialty chemicals, hydrogen technologies, robust regulatory compliance, and innovative recycling methods will define the future landscape of the chemical industry.

The main drivers include regulatory pressures from governments, increasing consumer demand for eco-friendly products, and the adoption of circular economy practices that promote recycling and waste reduction.

Digitalization enhances efficiency through data analytics, improves safety protocols, accelerates research and development with AI technologies, and allows for real-time monitoring via digital twins.

Supply chain resilience is crucial due to recent global disruptions that exposed vulnerabilities. Companies are focusing on local sourcing and reshoring operations to mitigate risks associated with geopolitical tensions.

Specialty chemicals are essential in high-demand sectors such as electronics, pharmaceuticals, and renewable energy. They enhance product functionality and performance across various applications.

Hydrogen technologies can significantly reduce reliance on fossil fuels by providing cleaner energy alternatives. Additionally, carbon capture utilization technologies help manage emissions from industrial processes.

This article highlights the top stannous sulfate manufacturers and suppliers in the UK, focusing on their product quality, industrial applications, and market presence. It emphasizes the UK's strength in producing high-purity stannous sulfate for surface treatment, water treatment, and electroplating industries. Key players like REAXIS and Atotech lead the market with innovative solutions, while OEM support and regulatory compliance remain core advantages of UK suppliers. The article also addresses the compound's uses and includes a detailed FAQ to assist industry professionals.

Germany leads Europe in Stannous Sulfate manufacturing, supplying high-purity, reliable chemicals essential for electroplating, glass production, pharmaceuticals, and more. Key German suppliers like TIB Chemicals AG, MCC Menssing, Univar Solutions GmbH, and VMP Chemiekontor GmbH offer tailored solutions, strict quality control, and global distribution for diverse industrial demands.

This article explores the top stannous sulfate manufacturers and suppliers in Europe, highlighting leading companies like TIB Chemicals and Chimica Panzeri. It details production technologies, quality standards, industry applications, and OEM services, offering insights for markets requiring high-purity stannous sulfate chemicals.

This article explores the top stannous sulfate manufacturers and suppliers in France, highlighting their product quality, compliance with environmental standards, customized OEM services, and key industrial applications such as aluminum surface treatment, electronics, pharmaceuticals, and wastewater management.

This article explores the top stannous sulfate manufacturers and suppliers in America, detailing key companies, product forms, industries served, manufacturing processes, quality controls, and environmental considerations. It highlights the benefits of sourcing stannous sulfate locally with customization and technical support options. Insightful images illustrate stannous sulfate forms, production, and applications in industrial processes. Finally, a FAQ section addresses common queries related to stannous sulfate use and supply.

This comprehensive report explores Japan's top nickel sulfate manufacturers and suppliers, highlighting their production capabilities, market positions, and product applications. Featuring companies like Sumitomo Metal Mining and SEIDO Chemical Industry, the article delves into manufacturing processes, industry uses, and environmental practices, reflecting the pivotal role of Japanese firms in the advancing global nickel sulfate market.

South Korea is a leading global hub for nickel sulfate manufacturing, dominated by Korea Zinc and KEMCO with a combined annual capacity of 80,000 tons. Leveraging advanced smelting technologies and government-supported strategic status, these manufacturers supply high-quality nickel sulfate for electric vehicle batteries, surface treatment, and chemical industries. South Korean suppliers offer comprehensive OEM services to international clients, meeting growing global demand with innovation, sustainability, and quality.

This article provides a comprehensive overview of leading nickel sulfate manufacturers and suppliers in Portugal, covering their technological capabilities, product lines, market roles, and strict compliance with international standards. Highlighting diverse applications from electroplating to battery manufacturing, it showcases Portugal’s growing importance in the global nickel sulfate supply chain. Accompanied by relevant images, the article emphasizes sustainability, innovation, and quality as cornerstones of the Portuguese chemical sector.

This article explores the top nickel sulfate manufacturers and suppliers in Spain, highlighting their product offerings, quality standards, and strategic advantages. It covers Spanish industry applications, OEM services, and explains why Spain is a preferred sourcing hub for global chemical buyers. The article also includes detailed FAQs and relevant images to provide a comprehensive understanding of the nickel sulfate market in Spain.

Italy’s nickel sulfate manufacturing and supply chain is advanced, diverse, and globally integrated—supporting key industries like batteries, electroplating, and catalysts. With leading companies, customized services, and sustainable practices, Italian nickel sulfate manufacturers and suppliers are crucial to meeting the world’s growing demand for this essential chemical.

This article provides an in-depth overview of the top nickel sulfate manufacturers and suppliers in Russia, focusing on major companies like Norilsk Nickel, their production processes, market presence, environmental initiatives, and the diverse industrial applications of nickel sulfate. It serves as a valuable resource for international businesses looking to source high-quality nickel sulfate from Russia.

Aluminum alloys have become indispensable materials in modern industry, owing to their light weight, high strength-to-weight ratio, corrosion resistance, workability, and versatility. However, their durability—especially when used in challenging environments—is critically dependent on

Electrophoretic coatings, often referred to as *E-coatings* or *electrophoretic deposition (EPD)*, have revolutionized surface finishing in the modern manufacturing landscape. They blend chemistry, material science, and advanced technology to create coatings that are durable, uniform, and environmen

Discover Europe's most prominent Nickel Sulfate Manufacturers and Suppliers, including sustainability-focused innovators and rapid-response distributors serving the EV, electroplating, and advanced materials sectors. Learn about top companies, key trends, market drivers, and FAQs to inform your industrial chemical sourcing decisions. This comprehensive guide highlights the critical role nickel sulfate plays in Europe’s green industrial future.

This article details France’s leading role in nickel sulfate production, covering major manufacturers and suppliers, innovative production methods, sustainability commitments, and the industry’s critical role in green technology supply chains. It also examines market drivers, regulatory compliance, and supply chain strategies while answering common industry questions. The content is especially relevant for businesses seeking OEM solutions for aluminum profile treatment and battery production.

This comprehensive guide details the leading Nickel Sulfate Manufacturers and Suppliers in Germany, highlighting their strengths, product applications, and why Germany is a global leader. It covers selection criteria, market trends, and answers to key FAQs for buyers and industry professionals.

This article offers a comprehensive guide to the UK’s top Nickel Sulfate Manufacturers and Suppliers, highlighting industry applications, leading brands, and sourcing strategies in the rapidly growing British and global markets. From surface finishing to electric vehicle batteries, discover how to select the right partner and stay ahead of industry shifts.

This article explores the top Nickel Sulfate Manufacturers and Suppliers in America, highlighting their key products, application areas, and essentials of reliable sourcing. With detailed industry profiles, market trends, future outlooks, and FAQs, it serves as a vital comprehensive resource for businesses seeking high-quality nickel sulfate and dependable partnership.

Choosing the best chemical raw materials for aluminum profiles is **critical to ensuring strength, durability, corrosion resistance, and sustainability** in the final products. The selection impacts not only the mechanical and aesthetic qualities but also influences cost-effectiveness, production ef

In the global industrial landscape, **chemical raw materials for surface treatment** play a critically transformative role in enhancing the durability, functionality, and aesthetics of countless products. Surface treatment chemicals help prevent corrosion, improve adhesion, increase wear resistance,